#challenge coin builder

Explore tagged Tumblr posts

Text

#challenge coin#design studio#challenge coin builder#coin builder#online challenge coins#custom coins#military coins#custom challenge coin#military challenge coins#challenge coins#custom military coin#custom military coins

0 notes

Photo

(via Tarot Encyclopedia - The Page of Coins or Pentacles)

#tarot#tarot reading#tarot cards#tarot community#tarot collection#tarot commissions#tarot challenge#aleister crowley#rider waite smith#rider waite tarot#builders of the adytum#page of pentacles#princess of disks#page of coins#divination#cartomancy#fortune telling#i ching#astrology

0 notes

Text

Mercury

The one who communicates, it is the Messenger.

Mercury is the smallest planet, closest to the Sun astronomically. Limited in how far it strays, it never moves further than 28 degrees from the Sun. It is considered to be the fastest planet, discounting the Moon’s speedy cycle. Of all the planets, Mercury is seen to have a dual nature, being neither purely feminine or purely masculine. It’s neither benefic or malefic, earning it the reputation of being ambiguous and impressionable. Through its travel through the zodiac, it will retrograde about 3 times a year.

Mercury is one of the two planets associated with the element of Earth, actually considered to be “slightly cold and dry” by astrologers Helena Avelar and Luis Ribeiro. As a result, Mercury would be assumed to be enduring, analytical, and thoughtful.

Mercury rules over the air sign Gemini, both ruling and exalting in the earth sign Virgo. In contrast, Mercury finds Jupiter’s signs of Sagittarius (detriment) and Pisces (detriment and fall) challenging.

Mercury joys in the 1st House, giving that house meaning in the Hellenistic tradition. Keep that in mind when considering Mercury and the 1st House’s significations.

forethought and intelligence, strategic actions, practical wisdoms, knowledge, reason, education, writing, speech, messages, connection through language and communication, eloquence, trust, friendship, fellowship, brothers, younger sons, children and nurslings, youth, play, contest, sports and athletics, numbers, calculations, weights and measures, coins, banking, business and marketing, mercantile activity, commerce, give and take, exchange, trade, brokerage, industrious people, ingenuity, travel, desire to learn and see other places, love of travel, cultural refinement, assistance, service and public services, community, teachers, mathematicians, doctors, lawyers, secretaries, printers, scribes, orators, poets, philosophers, architects, temple builders, modelers, sculptors, braiders and weavers, tailors, musicians, augers and diviners, prophets, dream interpreters, astrologers, those who are meticulous, investigation of mystery, discrimination, versatility, frenetic action, disorganization, mental disturbances such as madness, ecstasy, and melancholy, trickery, slight of hand, thievery, deception, rumors, tall tales, lies, discord, mockery, derision, provocations, argumentation debate. Of the body, the hands, shoulders, fingers, joints, the belly, the ears (hearing), the windpipe, intestines, the tongue.

Traditional 1st House Significations, Mercury’s House of Joy

the beginning of all actions, the overall life of the native, the body and one’s appearance, one’s physical constitution, one’s vital life force, one’s character and demenor, the mind and the matters it is concerned with, spirit, and speech.

Significations primarily sourced from Demetra George’s Ancient Astrology in Theory and Practice Volumes 1 and 2, Helena Avelar and Luis Ribeiro’s On the Heavenly Spheres, and planet significations spoken of on the Chris Brennan’s The Astrology Podcast.

Disclaimer: Please do not copy, redistribute, alter, or claim this text as your own…

#astrology#traditional astrology#natal astrology#natal chart#astrology notes#astrology basics#astroblr#astrology blog#zodiacal foundation#mercury

25 notes

·

View notes

Text

STON.fi Grant Program: Empowering Innovation in Web3

In a world where technology evolves at lightning speed, the STON.fi Grant Program stands as a beacon for Web3 developers and innovators. This program isn’t just about funding; it’s about building opportunities and strengthening the blockchain ecosystem. If you’re curious about how transformative ideas become reality in Web3, let me walk you through why the STON.fi Grant Program is a game-changer for developers and users alike.

What Is the STON.fi Grant Program

Imagine having a brilliant idea but lacking the resources to bring it to life. That’s the challenge many developers face. The STON.fi Grant Program steps in to bridge this gap by offering up to $10,000 in funding to promising blockchain projects.

But it doesn’t stop there. The program also provides technical support, access to the STON.fi SDK, and mentorship from experienced professionals. Whether you’re developing a decentralized app, exploring tokenomics, or building tools to simplify blockchain usage, this program equips you with the essentials to succeed.

Why Should You Care

At first glance, this might sound like a developer-focused initiative. But here’s the twist: the success of these projects impacts everyone in the blockchain ecosystem.

Think of it like this: if Web3 were a growing city, developers are the architects and builders. The more tools and resources they have, the better infrastructure they can create. As a user, this means smoother experiences, more diverse applications, and easier access to blockchain solutions. It’s like watching your city transform with new roads, bridges, and parks that improve daily life.

Real-Life Projects Making a Difference

To truly understand the value of the STON.fi Grant Program, let’s dive into some of the projects it supports. These aren’t just theoretical ideas—they’re real solutions addressing genuine challenges in Web3.

Uniramp: Simplifying Crypto for Everyone

Getting into crypto can feel like learning a new language. Uniramp makes it easier by offering a seamless way to convert fiat currency into crypto.

Using the STON.fi SDK, Uniramp is creating a future where users can trade fiat for TON and USDt directly through the STON.fi DEX. Imagine walking into a store with cash and walking out with crypto, minus the confusing middle steps. Uniramp is that store—straightforward and efficient.

Meme.live: Democratizing Meme Coin Launches

Meme coins are fun, but their launches often feel exclusive. Meme.live levels the playing field by ensuring fair launches without presales.

Here’s the kicker: if a meme coin on Meme.live gains traction, it automatically gets listed on STON.fi, giving users even more opportunities to trade. It’s like hosting a talent show where every contestant gets equal stage time, and the crowd decides who moves on.

TON Hedge: Simplifying Options Trading

Options trading can feel daunting, even for seasoned traders. TON Hedge simplifies the process by offering user-friendly options trading on the TON network.

The platform also enables payments using tokens available on STON.fi, making it versatile and accessible. It’s like betting on the outcome of a sports game—you predict, participate, and potentially win rewards, all while learning more about the process.

Building a Stronger Blockchain Ecosystem

The beauty of the STON.fi Grant Program lies in its ripple effect. When one project thrives, it strengthens the entire ecosystem.

For instance, Uniramp’s seamless fiat-to-crypto exchange can drive more users to platforms like Meme.live, while TON Hedge creates new earning opportunities for traders. It’s a network of interconnected innovations, each contributing to a bigger, better Web3.

How You Can Be Part of This Movement

Whether you’re a developer with a groundbreaking idea or an enthusiast looking to support blockchain growth, there’s a place for you in this story.

If you’re a builder, the STON.fi Grant Program offers the resources and support you need to turn your idea into reality. If you’re a user, you benefit directly from the tools and applications these projects bring to life.

Innovation doesn’t happen in isolation—it thrives on collaboration, support, and a shared vision for the future. The STON.fi Grant Program embodies this spirit by empowering developers and enriching the blockchain ecosystem.

Learn more

Whether you’re just exploring Web3 or deeply involved in its evolution, programs like this remind us of one thing: the future of blockchain is a collective effort. So, why not be part of it

4 notes

·

View notes

Text

What the heck is a ghost?

Ghosting is the act of making avatars for other users. This usually happens in the dressing room, a sub of the avatar talk thread (but sometimes you'll see it in the main AT thread or chatterbox)

Old farts (like me) might remember Tektek, which was similar in that you could make avis for people using its dream avatar simulator

but tektek is dead now! so what do you use?

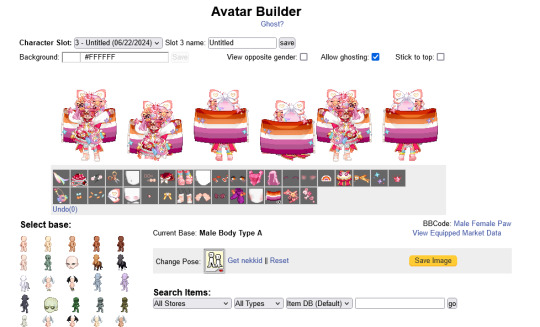

why gaia's own avatar builder! now i cant say this thing is great....in fact a lot of people hate it but its all we got (unless you wanna build inside the normal avatar function) you can also change its layout with gaiaupgrade if you have it

At the top you'll see the Ghost? button, this lets you open a lil box you can type in someone's Ghost ID (the numbers on your profile url are your id) or their username (new-ish feature!) and then BAM you have their lil avatar (provided they have ghosting turned on, remember if you're asking for a ghost to make sure its on! or to let someone know that its not on if you want to ghost them and theyre asking for them)

there's three inventory options from here

Item DB: this is every SINGLE item that is on gaia and in the avatar builder, this does include items you cannot get as they've either never been released or are limited to like...one person and whoever they give them out to (so good luck if you're using this as an actual way to find new items)

My Inventory: this is items YOU own, this will be the only other option if you are not actively ghosting someone (which means the default avi will be you) this could be a good way to find items you know that the person you're ghosting doesnt have

Ghost User Inventory: this will only show up once you're actively ghosting someone, make sure to check you're on this if they request to ONLY use their own items! now you can see every item they own! (provided its for the base they're currently using, ie you wont see any paw items for human bases)

You finished the ghost now what?

navigate to the bbc code area, pick the option that fits their base and then copy and paste the code into a reply in the thread you're showing the ghost off to. mind you the image only is hosted for a limited time (the list will always be there) so if you need to keep the image you might want to save it somewhere!

How do i ask for a ghost?

You want a new avatar but you're stumped, maybe you really want to cosplay your oc or a character but you're stuck! or maybe you have a challenge for someone!

You have two main options

make a new thread: go to the board of your choice, usually the dressing room but hey if you wanna post in CB go ahead. state what you're looking for, if you want it to be strictly your own items or not (and if not if you have a budget or not), and as many details as you want. dont care? tell em to go nuts. have extremely specific needs and hate most avis people make? give htem as much info as you can and try to provide previous avis if you can (or avis you're inspired by)

you can also tack this onto your closet thread if youve made one (or whatever fitting thread if you're hosting a contest or something)

or

look for someone's ghosting shop: these are threads that people will run where they ghost other people, usually for a fee (more on that in a second) or for free (they also might not be really stated to be a shop they might just wanna ghost you or its a ghost for ghost thread)

I can get paid?

Ya sure can! and you can pay others as well! How much you pay is really...up to you as there's not really a set price on what people pay for ghosts. I've gotten anything from the mithril coins, a couple grand, to nearly 100k for avatars. you also can send wishlist items, items you dont want (some people ghost to get rid of items), just the tipping button (which i believe goes up to 1k?), to gcash, and even art

you also...dont have to. some people do ghosts for free

now go out there and haunt people i mean make avis for them or get avis made for you

#gaia online#gaiaonline#boy i sure hope i covered everything#i feel like i make this sound way more complicated than it realy is#but ive seen people struggle to even post images so i am trying to be as detailed as possible

2 notes

·

View notes

Text

Steam Next Fest, fall 2023. I had time to play a good variety of game demos, and I picked out the ones that stood out the most to me this time around. Detailed thoughts and comments under the cut.

Beacon Patrol, Sky Settlers ��� The obligatory tile builders. Beacon Patrol plays like a variation on Carcassone; a bit more simplistic than its board game counterpart and I'd like to see more to it, but the idea of working together in multiplayer to set a high score is intriguing. Sky Settlers hews closer to Dorfromantik and ISLANDERS, and of the many games of that sort I've tried, it seems like one of the more fully realized ones. A lot of its ideas I've seen in other games and demos, but the ways they're used here feel pretty natural and fit together well.

Eklips, RETRIS, Oxytone – Arcade puzzle games, each of them putting a spin on an existing style of game: Oxytone places tiles to connect longer and longer winding paths, RETRIS plays like a somewhat warped version of Tetris, and Eklips drops blocks to fill out rows around a central square. There are some interesting ideas in each one, and good potential for them to be fleshed out a bit more.

Plungeroo, Oberty – More puzzle games. Plungeroo is a pinball-themed game about placing tiles and bumpers to make paths for pinballs to follow, with a charming variety of puzzles themed around different pinball tables. Oberty is a minimalist puzzle revolving around patterns and symmetry, and making different patterns out of the same base components. Both seem like the sort of game I might boot up, play a few levels, then a few more, then suddenly it's a day later and I've completed the entire game and am left wanting more.

Promenade, Pecker – A pair of games drawing inspiration from 3D platformers, in opposite directions. Promenade is a 2D platformer with a charming art style, and game mechanics somewhere on the spectrum between Klonoa or Mischief Makers (where the best way to get around is to grab enemies and vault over them) and Super Mario Odyssey (where each level is its own bite-sized collect-a-thon with challenges and objectives scattered throughout). Pecker takes a cue from Odyssey in a much more direct sense, in that it takes a specific power from a specific level and expands the core idea into an entire game based around it. Seems like both games could be refined into something fun.

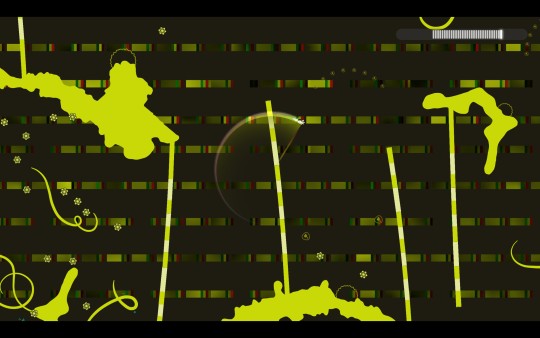

PixelJunk Eden 2 – A floaty, psychadelic platformer. The gameplay is simple and satisfying, but takes a back seat to the audio-visual experience, which is overflowing with style. I'm not actually familiar with the PixelJunk series; I've seen the name around here and there, but never really looked into it myself. If Eden is anything to go by, I might have to rectify that.

Sandy's Great Escape – One last puzzle game, this one more sokoban-esque. A good pixel-art style, a good variety of mechanics that ramp up in complexity at a fair pace, and an incentive for optimal puzzle-solving (which might be a curse as much as a boon; I can tell that trying to 100% complete this game and get all the coins is the sort of thing that might drive me up a wall). The crab will have his day.

Cobalt Core – A roguelite deckbuilder. Of all the games I tried out this time around, this one was the standout. I was intrigued by the pixel art and music when it was first annouced (which also brought my attention to the devs' previous title, Sunshine Heavy Industries, which shares the same style and is a puzzle game that seems very much up my alley), and the gameplay did not disappoint. It clicked with me immediately, and puzzling my way through each different encounter was very satisfying. There's a lot of potential for different decks and encounters, so there should be a lot to dive into when the game releases. I'm looking forward to it.

#cobalt core#pixeljunk eden#beacon patrol game#plungeroo game#oberty game#eklips game#bryan writes about games

3 notes

·

View notes

Text

Reasons Why Residential Property in Dwarka Mor is Affordable

Purchasing a property is a smart decision. However, exploring a cheap property in the right location is often more challenging. Especially in residential properties, such as a Dwarka Mor 2 BHK flat, the price is. It easily attracts homebuyers at an affordable rate. Here, the question arises: why?- Dwarka Mor in the current period has become the hotspot of the affordable housing segment. Therefore, we will know key points in this blog and why residential Property in Dwarka Mor is More Affordable.

1. Rapid infrastructure development -

Dwarka Mor is a rapidly emerging, elegant society in both commercial and residential areas. Interestingly, this bustling location is part of West Delhi and close to Asia’s largest sub-city, Dwarka. The excellent neighborhood growth directly impacts nearby localities such as Dwarka Mor and Uttam Nagar. Additionally, the Dwarka Expressway inauguration has had a major impact on southwest and west Delhi neighborhoods. Bharat Vandana Park, Chanakyapuri Diplomatic Enclave, Vegas Mall, and historical sites such as Dwarka Baoli and Hastsal Kutub Minar are all historical places of tourism. However, rapid infrastructure often plays a crucial role in a neighborhood’s real estate development.

2. Affordability -

According to a report by People Research on India's Consumer Economy, 67 % of the people in the national capital belong to the middle class. This report was released in 2022. According to People Research, Delhi has the highest number of middle-class people in the country. Delhi is not only the capital of India, but it is also known as the political capital of India. And it comes to huge opportunities like jobs, education, business, and health and well-being. In this case, many of us are forced to live in rented homes. However, cheap property has become their priority, and for this, Dwarka Mor Apartments are easy and attractive to middle-class home buyers.

3. Connectivity -

Growth and connectivity are the two sides of a coin; without them, development can never exist. Purchasing a 1 BHK flat in Dwarka Mor is an affordable housing location with excellent connectivity, such as the Blue Line metro, DTC Buses, Auto, and cabs, and easy connectivity with job hub centers.

4. Variety of Property-

Prime Property at a prime location generally attracts real estate investors, especially in West Delhi, Dwarka Mor has a lot of variety of residential properties i. e., including Independent houses, a Builder Floor, ready-to-move properties from 1BHK,2BHK,3BHK,4BHK, and 5 BHK often offers by Top Real estate Company in Delhi/NCR.

5. Peaceful location-

Nowadays, homebuyers prefer a peaceful location because crime is a major issue, and homebuyers often see it as a negative aspect. So they thoroughly anticipate both property and location before buying property. However, Dwarka Mor is a safe location even at night, people easily commute to their destination, because in the prime location, there are various police help booths and police patrolling. All these signs offer mental peace in the surroundings.

Conclusion-

Homebuyers must get out of this mentality, where an affordable price is considered a cheap quality home. Not at all, affordable housing or a cheap house never compromises the quality of construction or design. While it fits in the budget, with superb quality of building. However, Dwarka Mor's real estate property value’s deciding factor is closeness to the metro, wide roads, security facilities, amenities, and conveniences, also including an affordable rate.

Content Source - https://sanvirealestates.com/reasons-why-residential-property-in-dwarka-mor-is-affordable/

0 notes

Text

Beyond Entrepreneurship: Turning Your Business into an Enduring Great Company

Beyond Entrepreneurship: Turning Your Business into an Enduring Great Company

Starting a business is one thing, building one that lasts is something entirely different. In the early stages, most entrepreneurs are laser-focused on the fundamentals: developing a viable product, finding market fit, securing funding, and gaining traction. These are critical milestones but they represent only the beginning of the journey.

Once a company achieves initial success, many founders are faced with an entirely new challenge: how to grow without losing direction, culture, or clarity. It’s one thing to hustle your way to early wins, but quite another to evolve into a sustainable, values-driven, high-impact business that can thrive for decades.

That’s where the philosophy of Beyond Entrepreneurship steps in.

Coined and expanded upon by legendary author Jim Collins in his book BE 2.0: Turning Your Business into an Enduring Great Company, this approach moves beyond the traditional startup mindset. It challenges founders not just to think like entrepreneurs but to lead like builders of greatness. It asks important questions:

What does it take to create a company that stands the test of time?

How can you scale without breaking your culture?

How do you keep your purpose alive as your business grows?

And how do you lead with both humility and unshakable resolve?

In today’s hyper-competitive, fast-moving market, longevity is the ultimate advantage. And yet, it's often overlooked in favor of speed and short-term gains. The truth is, the most iconic companies, the ones that continue to innovate, inspire, and influence aren’t built on quick wins. They’re built on clarity of purpose, disciplined leadership, and strategic evolution.

At Entrepreneurial Era Magazine, we believe this long-term thinking is what separates fleeting success from enduring greatness. That’s why we’ve made it a cornerstone of our editorial focus spotlighting the founders, frameworks, and philosophies that help businesses go the distance.

If you're a founder who’s ready to think bigger than the next quarter, and you're asking yourself how to future-proof your business, Beyond Entrepreneurship is your blueprint and we’re here to help you bring it to life.

The Jim Collins Framework: BE 2.0

The original Beyond Entrepreneurship, co-authored by Jim Collins and Bill Lazier, was a powerful but often overlooked gem in the world of business literature. With the release of the updated edition BE 2.0: Turning Your Business into an Enduring Great Company Collins breathes new life into the original work, integrating decades of research, real-world case studies, and strategic insights that go far beyond startup fundamentals.

BE 2.0 is not your typical business book filled with surface-level tactics or fleeting buzzwords. Instead, it serves as a comprehensive roadmap for founders and business leaders who want to build companies that not only survive, but thrive for generations. Collins doesn’t just talk about success he breaks down what sustained greatness looks like and how to achieve it deliberately.

The book presents a powerful set of guiding principles rooted in years of research into what separates enduring companies from the rest. These principles include:

🔭 Crafting a visionary purpose that becomes the north star for decision-making. Collins stresses that great companies are not driven solely by profit but by a deep, enduring reason for existing something that galvanized teams and guides strategy across every phase of growth.

🧱 Building a values-based culture from day one. Culture isn’t something you tack on later, it's baked into the DNA of the organization. BE 2.0 emphasizes the importance of defining and protecting your company’s core values early, ensuring that they shape hiring decisions, customer experiences, and leadership behavior.

🧠 Developing Level 5 leadership. This concept, introduced in Good to Great and expanded in BE 2.0, refers to a unique blend of personal humility and fierce professional will. These are leaders who put the mission and the team above ego and who consistently make disciplined, high-impact decisions over the long haul.

⚙️ Creating systems that scale, so your business can grow without chaos. Collins walks readers through how to implement structures that support innovation, maintain alignment, and enable adaptability so you're not constantly rebuilding as you expand.

🧭 Outlasting competitors in turbulent markets. Perhaps most important of all, BE 2.0 equips leaders to build companies that are resilient, responsive, and rooted, able to navigate change, seize opportunity, and come out stronger on the other side.

At Entrepreneurial Era Magazine, we frequently reference Collins' framework because it aligns perfectly with the mindset shift we encourage: from founder to long-term leader. In a world where many businesses rise fast and fall faster, BE 2.0 provides the wisdom and tools to help you build something truly exceptional and enduring.

Why This Matters for Founders Today

In today’s high-speed, hyper-competitive startup landscape, entrepreneurs are constantly bombarded with the latest trends, growth hacks, and “overnight success” formulas. The pressure to scale quickly and pivot rapidly is intense. While speed and adaptability are important, true business greatness isn’t built on viral moments or trendy tactics, it's built on principles that stand the test of time.

Jim Collins’ work reminds us that endurance beats excitement. The companies that achieve long-term relevance don’t just chase what’s popular today they build from a place of discipline, purpose, and strategic clarity. They lay solid foundations before stacking growth, and they stay true to their core mission even as the world around them shifts.

At Entrepreneurial Era Magazine, we’ve seen this play out across countless founder journeys. The entrepreneurs we admire most the ones who scale with integrity and consistency aren’t necessarily the loudest or fastest movers. They’re the ones who think long-term. They design cultures that last, lead with humility, and invest in systems that outlive any single product or campaign.

Many of the founders we interviewed and spotlight didn’t start with massive resources or flawless plans. What set them apart was a deep commitment to building something that matters, something worth passing on. They didn’t just want to “win the market.” They wanted to build a legacy.

Enduring companies don’t merely react to the environment; they read it, anticipate it, and strategically evolve through it. They are proactive, not reactive. Resilient, not rigid. Focused, not frantic. And they are built by founders who choose the long game, even when the short-term gains are tempting.

This mindset shift from hustling for traction to building for the future is exactly what Beyond Entrepreneurship champions. And it’s at the heart of everything we share through Entrepreneurial Era Magazine. Because we believe the next wave of legendary companies will come from those who build with intention, lead with vision, and grow with purpose.

Entrepreneurial Era’s Take on Long-Term Success

At Entrepreneurial Era Magazine, we believe that building a lasting company isn’t just an ideal it’s a discipline, one that can be learned, refined, and mastered. That’s why we go beyond surface-level advice and dive deep into the philosophies and strategies that empower entrepreneurs to think beyond the next quarter and start planning for the next decade.

Each month, our editorial team curates actionable insights drawn directly from foundational texts like BE 2.0 and real-world startup case studies. We don’t just quote the greats, we show how modern founders are putting those principles into practice in today’s fast-changing business environment.

Here’s what you’ll find inside every issue:

🔍 Leadership Spotlights We feature in-depth interviews with startup leaders who are building more than just scalable products; they're building resilient teams, strong cultures, and organizations with clear missions. These stories offer firsthand wisdom on navigating uncertainty while holding onto your vision.

📈 Scaling Strategies Our growth features highlight how smart founders prioritize systems, structure, and sustainability over rapid (and risky) expansion. From operational frameworks to talent development and customer experience, we spotlight how long-term thinkers scale without burning out or breaking their business.

🌍 Startup Ecosystem Features From Silicon Valley to rising hubs around the world, we explore how ecosystem dynamics, mentorship, funding access, community support, and policy shape business longevity. Learn how founders can tap into the right environments and partnerships to go further, faster, and stronger.

In every article, our goal is to bridge the gap between inspiration and execution. Whether you’re a first-time founder or a seasoned entrepreneur, Entrepreneurial Era Magazine equips you with the tools, context, and clarity to build something meaningful and make it last.

Key Takeaways for Founders Who Want to Go Beyond

If you're ready to evolve from the day-to-day hustle of startup life into the visionary role of a long-term builder, it starts with a shift in mindset and a commitment to play the long game. The most enduring companies didn’t just grow fast they grew smart, guided by a deeper purpose, intentional culture, and strategic structure.

Here are five actionable principles that can help you transition from founder to legacy leader:

🔍 1. Define Your Core Purpose Beyond Profits

Growth is important, but why you grow matters more. Clarify the deeper mission behind your business. What problem are you solving? Whose life are you improving? A clear purpose becomes your compass in moments of doubt and your rallying cry during scale.

🤝 2. Build a Culture That Lasts Hire for Values, Not Just Skills

Your team is your company’s backbone. Prioritize hiring people who align with your values, not just your current needs. Culture is what scales trust, fuels retention, and turns a good company into a great one. It’s not just a “nice to have” it’s your foundation for endurance.

⚙️ 3. Invest in Systems Early Stop Firefighting, Start Scaling

If your business can’t run without you, it’s a bottleneck. Start building repeatable systems and processes that allow your business to grow without burning you out. From operations to customer experience, create infrastructure that supports both agility and consistency.

🎯 4. Focus on Customers, Not Competitors

While others obsess over the competition, focus on delivering unique, undeniable value to your customers. Innovation rooted in service and authenticity creates a moat no competitor can cross. Your goal isn't to win a race, it's to change the game.

📚 5. Read, Learn, and Stay Strategic

Founders who lead enduring companies are students for life. Books like Beyond Entrepreneurship offer timeless frameworks, while regular reading of Entrepreneurial Era Magazine gives you access to modern insights, case studies, and leadership strategies that keep you grounded, focused, and ahead of the curve.

Ready to Build a Company That Lasts?

Don’t just aim for quick wins, aim for greatness. In a world obsessed with rapid growth and overnight success, it takes boldness and clarity to build something that truly endures. Whether you're launching your first venture or scaling a thriving business, the real path to longevity lies in intentional leadership, purpose-driven culture, and a long-term mindset.

📘 The journey isn’t always easy but you don’t have to take it alone.

✅ Subscribe to Entrepreneurial Era Magazine and get exclusive access to the tools, strategies, and stories that empower visionary founders to go beyond the startup phase and build companies that evolve, inspire, and stand the test of time.

Your legacy starts with what you build today. Let us help you build something that lasts.

FAQs

1. What makes Beyond Entrepreneurship different from other startup books?

Beyond Entrepreneurship (BE 2.0) isn’t just a guide to launching a startup, it's a roadmap for building a company that lasts. Unlike books focused on fast growth or early traction, BE 2.0 dives into the principles of leadership, culture, purpose, and long-term strategy. Jim Collins combines data-driven insights with timeless wisdom, making it ideal for founders who want to build mission-driven, resilient companies. It’s about shifting from hustle to legacy and crafting a vision that can adapt and thrive over decades, not just years. That’s why Entrepreneurial Era Magazine often references it in our leadership and growth strategy features.

2. How does Entrepreneurial Era Magazine help startup founders?

Entrepreneurial Era Magazine delivers real-world business insights specifically tailored to entrepreneurs and growth-focused founders. Each issue includes expert interviews, startup spotlights, and deep dives into strategic topics like leadership, scaling, product-market fit, and ecosystem building. Unlike generic business blogs, EE curates actionable lessons from experienced entrepreneurs and connects them with modern-day challenges. Whether you're bootstrapping, raising capital, or scaling systems, our content helps you think more strategically and execute more confidently. Our subscribers stay ahead of the curve by applying proven frameworks, avoiding common pitfalls, and evolving with the rapidly changing entrepreneurial landscape.

3. Why is long-term vision important in a startup?

A long-term vision gives your startup direction beyond initial goals or hype. While early traction and funding can fuel short-term success, only a well-defined mission can keep a business grounded during uncertainty. Vision helps attract the right people, guide decision-making, and shape a sustainable company culture. Startups without long-term clarity often burn out or lose relevance. With a strong vision, founders build something bigger than themselves, something that can evolve and endure. That’s why books like BE 2.0 and insights from Entrepreneurial Era Magazine emphasize vision as a cornerstone of strategic leadership.

4. How do I build a startup culture that scales?

Scalable culture starts with defining clear values early on and consistently living them. Hiring people who align with your values (not just your job descriptions) is crucial. As your team grows, systematize those values through rituals, feedback loops, and leadership behaviors. Culture isn’t just “feel-good” work, it's the glue that holds teams together during pressure and transition. Strong cultures drive performance, retention, and adaptability. Entrepreneurial Era Magazine regularly features founders who’ve scaled their teams while staying true to their core culture, helping readers replicate their success through intentional design and leadership.

5. What are some common mistakes that prevent long-term success?

Founders often focus too much on short-term wins like vanity metrics, fast fundraising, or chasing trends. Others neglect building systems, ignore culture, or resist adapting to market shifts. These mistakes can stall growth or lead to burnout. Another big one? Failing to clarify purpose and vision. Companies without direction lose focus or fizzle out. At Entrepreneurial Era Magazine, we help entrepreneurs identify and avoid these common traps through expert-backed content, real-world examples, and frameworks from books like Beyond Entrepreneurship and Good to Great turning short-lived startups into lasting companies.

6. How can I create a business that runs without me?

To build a self-sustaining business, focus on creating repeatable systems and empowering others to lead. Document your processes, build leadership capacity within your team, and define metrics for accountability. It’s about shifting from doing to designing so the business can grow beyond your direct input. This allows you to step back and focus on vision, partnerships, or innovation. Books like The E-Myth Revisited and tools shared in Entrepreneurial Era Magazine can help you create this infrastructure early so you’re not the bottleneck in your own business.

7. How can startup founders deal with uncertainty and change?

Embracing uncertainty is a key trait of successful founders. The best way to deal with change is to stay flexible in execution while staying firm in purpose. Develop mental resilience, build a strong advisory circle, and keep refining your strategy with feedback from customers and your team. Reading the right material like The Hard Thing About Hard Things or The Innovator’s Dilemma gives context and tools. At Entrepreneurial Era Magazine, we profile founders who’ve navigated pivots, recessions, and industry disruptions, sharing their stories and strategies so you can apply them to your own journey.

8. How important is the startup ecosystem to long-term success?

Your environment can accelerate or stall your growth. Being part of a supportive ecosystem filled with mentors, investors, collaborators, and learning communities gives you access to resources, feedback, and credibility. Ecosystems create momentum and open doors that solo efforts can’t match. Books like The Startup Community Way explore this in depth, and Entrepreneurial Era Magazine frequently highlights how founders leverage their local and global ecosystems to grow smarter and faster. Founders who engage with their environment proactively tend to build more resilient and enduring companies.

9. What’s the best way to scale a startup sustainably?

Sustainable scaling means growing without breaking your team, systems, or customer experience. This involves setting clear priorities, tracking meaningful metrics, and refining your operations before expanding. Avoid over-hiring or over-promising just to chase growth. Instead, develop a roadmap that includes people, processes, and culture. Books like Traction and Blitzscaling offer structured approaches, while Entrepreneurial Era Magazine shares how modern founders scale with stability by focusing on long-term performance instead of short-term hype.

10. Why should I subscribe to Entrepreneurial Era Magazine?

If you're serious about building a business that endures, Entrepreneurial Era Magazine is your monthly strategic advantage. We combine timeless lessons from the world’s top business books with real-time insights from active entrepreneurs. Each issue is packed with growth frameworks, founder interviews, and actionable content across leadership, culture, funding, operations, and innovation. Our readers are not just looking for hacks, they're building legacies. Subscribing means staying ahead of the curve, avoiding common pitfalls, and learning directly from those who've turned startups into long-lasting companies. It’s your blueprint for smarter, stronger, and more sustainable entrepreneurship.

#how to build a successful business long term#leadership strategies for entrepreneurs#building a lasting business brand#turning a startup into a great company#sustainable business growth tips#entrepreneurship to business legacy#scaling a small busine

0 notes

Text

0 notes

Text

Is a Newly Built Home Right for You? The Pros and Cons

When searching for a home, you don’t want to skip over new builds as an option. Right now, there are more newly built homes to choose from than there would normally be in the market. And those added choices come with some pretty incredible benefits. Talking to your agent is the best way to see if this type of home makes sense for you.

Here’s a quick rundown of some things your agent will walk you through – including a few of the top perks of buying a newly built home today and some potential things you’ll want to think about before you ink any contracts.

The Perks of Buying a Newly Built Home

Customization Options: Many builders allow buyers to choose finishes, layouts, and upgrades so that you can personalize your home to your unique sense of style. This is obviously more of a draw if the home is still under construction, but sometimes you can have a builder agree to some tweaks even after it’s completed.

Less Maintenance and Fewer Repairs: Everything from the roof to the appliances is brand new, which should save you on any upfront maintenance or repair costs — for at least the first few years. Many builders also offer warranties on things like structural components and major systems, to give you extra peace of mind. And not having to worry about this sort of thing is a big perk when everything feels so expensive right now.

Eco-Friendly and Energy-Efficient Features: With stricter building codes, newly built homes tend to be more environmentally friendly. This can include energy-efficient upgrades like smart thermostats and high-efficiency HVAC systems or eco-friendly tech. And all of these features can save you money on your future energy bills – again a welcome relief while inflation is stubbornly high.

Builder Incentives: Some builders are also offering incentives to homebuyers. While this will vary by builder, it could include rate buy-downs or other ways to offset today’s affordability challenges. As Bankrate says:

“Some builders offer financial incentives, including flexible financing options, to encourage buyers to purchase. These incentives — especially if they get the buyer a lower interest rate — could make a new-construction home more affordable in the long run.”

Other Considerations When Buying a Newly Built Home

On the other side of the coin, there are some things that you’ll want to at least consider before making your choice.

Longer Timelines: If you’re purchasing a home that’s still under construction, you may have to wait several months — or longer — before you can move in. As Realtor.com puts it:

“For homebuyers who have a short time frame to move into a new home, buying new construction could be challenging if the house isn’t built yet. This is not always the case, since a community may have some quick move-in homes or spec homes that are already complete (or nearly so) and ready for a buyer to move in. But if not, a buyer may have to wait.”

Potential Price Changes: Keep an eye on costs, too. It’s easy to go over budget if you keep tacking on upgrades or add-ons as you customize your build. At the same time, building materials, like lumber, can be affected by the economy, inflation, and changing trade policies. And unfortunately, if the cost of supplies climbs, builders will pass at least some of that increase on to people like you. As HousingWire explains:

“Upgrades and add-ons, unforeseen delays due to weather, supply chain issues or labor shortages, and expenses like landscaping and fencing not included in the builder’s cost can significantly affect the final price.”

Bottom Line

New builds can be a great choice today, but you want to be sure you have all the information you need to make an informed decision on such a big purchase. That’s where my expertise and experience is extra important.

Would you consider a newly built home? Why or why not?

0 notes

Text

Is a Newly Built Home Right for You? The Pros and Cons

When searching for a home, you don’t want to skip over new builds as an option. Right now, there are more newly built homes to choose from than there would normally be in the market. And those added choices come with some pretty incredible benefits. Talking to your agent is the best way to see if this type of home makes sense for you.

Here’s a quick rundown of some things your agent will walk you through – including a few of the top perks of buying a newly built home today and some potential things you’ll want to think about before you ink any contracts.

The Perks of Buying a Newly Built Home

Customization Options: Many builders allow buyers to choose finishes, layouts, and upgrades so that you can personalize your home to your unique sense of style. This is obviously more of a draw if the home is still under construction, but sometimes you can have a builder agree to some tweaks even after it’s completed.

Less Maintenance and Fewer Repairs: Everything from the roof to the appliances is brand new, which should save you on any upfront maintenance or repair costs — for at least the first few years. Many builders also offer warranties on things like structural components and major systems, to give you extra peace of mind. And not having to worry about this sort of thing is a big perk when everything feels so expensive right now.

Eco-Friendly and Energy-Efficient Features: With stricter building codes, newly built homes tend to be more environmentally friendly. This can include energy-efficient upgrades like smart thermostats and high-efficiency HVAC systems or eco-friendly tech. And all of these features can save you money on your future energy bills – again a welcome relief while inflation is stubbornly high.

Builder Incentives: Some builders are also offering incentives to homebuyers. While this will vary by builder, it could include rate buy-downs or other ways to offset today’s affordability challenges. As Bankrate says:

“Some builders offer financial incentives, including flexible financing options, to encourage buyers to purchase. These incentives — especially if they get the buyer a lower interest rate — could make a new-construction home more affordable in the long run.”

Other Considerations When Buying a Newly Built Home

On the other side of the coin, there are some things that you’ll want to at least consider before making your choice.

Longer Timelines: If you’re purchasing a home that’s still under construction, you may have to wait several months — or longer — before you can move in. As Realtor.com puts it:

“For homebuyers who have a short time frame to move into a new home, buying new construction could be challenging if the house isn’t built yet. This is not always the case, since a community may have some quick move-in homes or spec homes that are already complete (or nearly so) and ready for a buyer to move in. But if not, a buyer may have to wait.”

Potential Price Changes: Keep an eye on costs, too. It’s easy to go over budget if you keep tacking on upgrades or add-ons as you customize your build. At the same time, building materials, like lumber, can be affected by the economy, inflation, and changing trade policies. And unfortunately, if the cost of supplies climbs, builders will pass at least some of that increase on to people like you. As HousingWire explains:

“Upgrades and add-ons, unforeseen delays due to weather, supply chain issues or labor shortages, and expenses like landscaping and fencing not included in the builder’s cost can significantly affect the final price.”

Bottom Line

New builds can be a great choice today, but you want to be sure you have all the information you need to make an informed decision on such a big purchase. To weigh the pros and cons, connect with a local agent.

0 notes

Text

Can Cryptocurrency Make You Rich

Summary

Cryptocurrency has stormed the financial world, promising anyone bold enough to invest riches and economic freedom. But can you get rich from cryptocurrency?

Success Stories in Cryptocurrency

Tons of investors have hit the jackpot with crypto. Bitcoin’s early users, for instance, profited immensely. Ethereum made millionaires, too, as its value soared. Those who mined coins and/or timed their trades correctly have gotten rich through this process.

Crypto That Will Make You Rich in 2025

With this in mind, five prominent cryptocurrencies with excellent return on investment possibilities will be showcased to you, and these will have the potential to reshape the financial landscape as we know it. With 2025 around the corner, investors are looking for crypto that can make you rich in 2025. Here’s a closer look at some strong candidates waiting in the wings for growth potential.

1. Ethereum (ETH)

This sentence is not suitable for questioning. As Ethereum transitions to Ethereum 2.0 and the adoption of decentralized applications (dApps) continues to grow, ETH presents a prime investment opportunity in 2025.

2. Solana (SOL)

Solana is making waves in the NFT and DeFi landscapes due to its speedy transaction times and minimal fees. Experts say Solana could reward making back some very good at making it a strong candidate for wealth generation.

3. Polkadot (DOT)

Managing multiple blockchains is where Polkadot comes into play. With a focus on interoperability, DOT is set to become one of the hottest tokens in the coming months and offers strong investment potential.

4. Cardano (ADA)

With its commitment to scalability and sustainability, Cardano continues attracting developers and investors. Its ongoing updates and robust ecosystem make it a potential wealth-builder in 2025.

5. Emerging Cryptos and Meme Coins

Keep an eye on newer projects with strong utility and community support. While high-risk, these can yield massive rewards if chosen wisely.

Key Factors That Determine Your Success in Cryptocurrency

The cryptocurrency market is an exciting yet challenging domain, requiring strategic thinking and informed decisions. If you’re wondering about the key factors that determine your success in cryptocurrency, this concise guide covers everything you need to know.

1. Knowledge and Research

Understanding blockchain technology, market trends, and the utility of various coins is crucial. Stay updated on news, regulatory changes, and emerging tokens to make informed investment choices.

2. Risk Management

Volatility is the hallmark of cryptocurrency. Diversify your portfolio, set stop-loss orders, and invest only what you can afford to lose. These risk management techniques can safeguard your capital.

3. Market Timing

Timing plays a pivotal role in crypto success. Identify optimal entry and exit points using market analysis and indicators like RSI, MACD, and trading volume.

4. Long-Term Perspective

Adopting a long-term approach rather than chasing quick gains can lead to better results. HODLing strong projects often outweigh impulsive trading.

5. Security Practices

Safeguarding your assets is non-negotiable. Use hardware wallets, enable two-factor authentication, and avoid sharing private keys to prevent hacks.

6. Emotional Discipline

Fear and greed can cloud judgment. Develop a trading plan and stick to it, avoiding impulsive decisions driven by market sentiment.

7. Community Engagement

Engage with crypto communities and forums to gain insights from seasoned investors. Platforms like Reddit, Telegram, and Discord host discussions on potential opportunities. By focusing on these factors, you can increase your chances of success in the dynamic world of cryptocurrency. Stay patient, informed, and strategic to navigate this evolving market.

youtube

5 Ways Can Bitcoin Make You Rich

Bitcoin has captured the imagination of investors worldwide, sparking a burning question: Can Bitcoin make you rich? The answer depends on several factors, including timing, strategy, and risk tolerance.

1. Early Adoption vs. Current Market

Early adopters who invested when Bitcoin was a few dollars reaped massive returns. However, with Bitcoin’s current valuation, replicating such exponential gains requires a significant market surge or long-term holding.

2. Volatility and Risk

Bitcoin’s price swings are notorious. While volatility creates opportunities for high profits, it also brings the risk of steep losses. Investors must navigate this roller-coaster ride carefully.

3. Long-Term Investment Potential

Bitcoin is often called “digital gold” due to its limited supply. Many believe its value will increase over time, making it a viable option for long-term wealth accumulation.

4. Understanding Market Dynamics

Success in Bitcoin investing isn’t solely about buying and holding. Understanding market trends, technical analysis, and external factors like regulatory changes can significantly enhance your outcomes.

5. Diversification Matters

Relying solely on Bitcoin might not be the wisest strategy. Diversifying your crypto portfolio can minimize risks while increasing the chances of overall profitability. While Bitcoin has made many people rich, it’s not a guaranteed path to wealth. Educate yourself, stay informed, and adopt a balanced approach to maximize your chances of success.

Can Crypto Airdrop Make You Rich

Crypto airdrops have become a popular way for projects to distribute free tokens to potential users, but can crypto airdrops make you rich? While it’s not guaranteed, airdrops can provide significant opportunities for those who approach them strategically.

What Are Crypto Airdrops?

A crypto airdrop involves a blockchain project distributing free tokens or coins to the wallets of existing users or participants. Airdrops typically reward early adopters or those who complete certain tasks like signing up for newsletters, joining social media channels, or holding specific tokens.

Can Crypto Airdrop Make You Rich?

While airdrops can offer free tokens with future potential, turning them into substantial wealth depends on several factors:

Token Value: Some airdropped tokens might appreciate significantly, while others may have little to no market value.

Timing: Early participation in high-potential projects gives you a chance to gain valuable tokens before they hit the market.

Project Success: If the project behind the airdrop gains traction, the tokens could increase in value, leading to profits.

How Many People Became Billionaires From Bitcoin

Bitcoin’s meteoric rise has transformed not only markets but also the lives of many early adopters and investors. A key question for enthusiasts is: How many people became billionaires from Bitcoin? While the exact number fluctuates, several high-profile individuals and early investors have reached billionaire status through Bitcoin and other cryptocurrencies.

1. Early Adopters and Visionaries

Individuals like the Winklevoss twins famously invested early in Bitcoin, turning their initial millions into billions as the cryptocurrency’s value soared. Their story highlights the importance of foresight and patience.

2. Crypto Entrepreneurs

Figures such as Changpeng Zhao (CZ), founder of Binance, and Brian Armstrong of Coinbase built fortunes by creating platforms that facilitated Bitcoin trading and adoption. Their success stems from innovation within the crypto ecosystem.

3. Blockchain Pioneers

Satoshi Nakamoto, Bitcoin’s pseudonymous creator, is believed to hold approximately 1 million Bitcoins, making them a theoretical billionaire—if those coins are ever accessed.

4. Investors and Institutions

Several early investors, hedge funds, and institutions that embraced Bitcoin during its infancy have also reached billionaire status, showcasing the transformative financial potential of the cryptocurrency.

The number of billionaires created by Bitcoin is relatively small compared to traditional industries, but it underscores the power of early adoption and strategic investment. For aspiring investors, the Bitcoin journey offers lessons in innovation, risk management, and the value of staying ahead of technological trends.

Best Cryptocurrency To Invest in Today

Investing in cryptocurrency has become one of the most talked-about topics in the financial world. As digital assets grow in popularity, selecting the best cryptocurrency to invest in today can seem overwhelming. Here’s a quick guide to help you make informed decisions.

Top Cryptocurrencies to Watch

Bitcoin (BTC) Bitcoin remains the gold standard of cryptocurrencies. With its dominance in the market and widespread acceptance, it’s often a go-to for both beginners and seasoned investors.

Ethereum (ETH) Known for its smart contract capabilities, Ethereum powers decentralized applications (dApps) and is a favorite among developers and investors alike.

Binance Coin (BNB) As the utility token for the Binance ecosystem, BNB has shown consistent growth. Its use in trading fees and DeFi projects makes it a strong contender.

Cardano (ADA) Cardano is praised for its focus on sustainability and scalability, making it an eco-friendly investment option.

Polkadot (DOT) With a mission to connect different blockchains, Polkadot offers unique interoperability solutions, attracting long-term investors.

Factors to Consider Before Investing

When exploring the best cryptocurrency to invest in today, consider factors like market trends, technology advancements, and the team behind the project. Also, assess your risk tolerance and diversify your portfolio for better results. Read More

#crypto#cryptocurrency#cryptotrading#investing#bitcoin#stock market#future of cryptocurrency#blockchain#Cryptocurrency Make You Rich#Cryptocurrency Rich#Cryptocurrency To Invest#Youtube

1 note

·

View note

Text

Plot vs Flat: Which One is a Better Investment Option?

Introduction: Plot vs Flat – Understanding the Investment Options

When it comes to investing in real estate, the choice between buying a plot or a flat is often a subject of confusion. As a potential investor, I have encountered the dilemma myself.

The significance of this decision cannot be overstated, as it involves a long-term financial commitment that demands careful consideration.

Moreover, the perspectives of first-time homebuyers and seasoned investors vary greatly. In this discussion, we will explore the pros and cons of both options, backed by valuable insights from industry experts and experienced individuals in the field.

Let’s dive in and unravel the complexities of choosing between a plot and a flat for investment purposes.

The significance of buying a plot or flat and the confusion around choosing the best option

The importance of purchasing either a plot or a flat and the perplexity surrounding the decision-making process are significant. There are several key factors to consider while deciding which option to choose for real estate investment.

1. Flexibility in construction and customization – flats lack control over design and construction, while plots offer complete freedom in the building process. 2. Effort and amenities offered – flats provide convenience in terms of amenities and maintenance, whereas plots require more effort but allow for personalized development. 3. Expenses involved – flats’ construction cost is influenced by location, while plots’ construction cost depends on positioning within the plot. 4. Property value appreciation – flats experience some depreciation over time, whereas plots have an increasing demand due to scarcity and future infrastructural developments. 5. Rental income potential – well-constructed flats can generate rental income, whereas plots offer long-term income possibilities through developing apartment units. 6. Risk factors – quality concerns surround flats’ construction materials, and plot investments face risks associated with lowering property rates. 7. Financing options – obtaining home loans for flats is relatively easy due to builder affiliations, while financing for plots can be challenging. 8. Tax benefits – tax deductions are available on home loans for flats, whereas deductions on plots only apply after construction completion.

Choosing between a plot and a flat requires more than just a coin toss – it’s a long-term financial commitment that demands careful consideration.

Long-term financial commitment and the need for careful consideration

Investing in a property requires a long-term financial commitment and careful consideration to ensure maximum return on investment. It is crucial to weigh the pros and cons of different options before making a decision.

Considering the potential growth and stability of the real estate market, it becomes imperative to align one’s investment goals with their financial capabilities and preferences.

In this context, individuals must carefully evaluate the long-term financial commitment associated with their investment choice. Whether purchasing a plot or a flat, it is essential to consider factors such as construction type, expense involved in construction, return on investment/appreciation of property, income from property, risk involved, financing options, and tax benefits.

Each factor plays a significant role in determining the overall profitability and success of the investment. For instance, individuals opting for flats might have limited control over the construction process and customization options.

On the other hand, those choosing plots enjoy complete freedom in designing and constructing their dream home according to their preferences. Additionally, while flats offer amenities that require less effort on the part of homeowners, plots come with the opportunity to create customized amenities based on personal needs.

Furthermore, estimating the expense involved in construction is essential for budgeting purposes. The location of flats can significantly impact their costs due to factors like proximity to city infrastructure and amenities.

Similarly, factors like accessibility and availability of resources influence construction costs for plots. Moreover, considering the potential appreciation of property value is crucial when making an investment decision. While flats may face limitations in terms of value depreciation over time, plots tend to gain value due to increasing demand and scarcity.

Modifications made to properties along with infrastructural developments can further enhance their value. Additionally, rental income potential varies between flats and plots. Well-constructed flats have higher chances of generating rental income over time compared to building apartment units on plots.

However, long-term income possibilities should also be considered when deciding between these two options. Evaluating risks associated with construction quality and potential litigation becomes important. Flats have been associated with concerns regarding compromised construction materials, while lowering property rates pose risks for plot investments.

Furthermore, financing options play a crucial role in investment decisions. Flats often have better financing options due to builder affiliations, while obtaining home loans for plots can be challenging.

Lastly, tax benefits also differ between flats and plots. Tax deductions on home loans for flats are available during the monthly repayment period, while deductions on plots are applicable only after completion of construction. The dreamers see a home, while the investors see a potential gold mine.

Different perspectives of first-time homebuyers and investors

– First-time homebuyers often prioritize factors like affordability, proximity to amenities, and ease of financing. They are more focused on finding a comfortable and convenient living space. – Investors, on the other hand, are primarily concerned with the potential return on investment. They consider factors such as property appreciation, rental income potential, and long-term income generation.

In summary, first-time homebuyers prioritize immediate comfort and convenience, while investors focus on long-term financial gains from their investment properties.

A true fact: According to a study conducted by Real Estate Agencies, 75% of first-time homebuyers invest in flats for their first property purchase.

Flats may lack control over construction, but plots offer complete freedom in designing and building, making them the ultimate DIY project.

Construction Type: Freedom vs Convenience

When it comes to choosing between flats and plots for investment, the construction type plays a crucial role. Flats offer convenience with ready-made structures, but they can lack control over customization.

On the other hand, plots provide complete freedom in designing and construction. In this section, we will delve into the differences between these two construction types and the level of effort required for each.

Furthermore, we will compare the amenities offered by flats and plots, providing insights into which option may be the better investment choice.

Flats – Lack of control over construction and customization

When considering flats as an investment option, one must be aware of the limited control over construction and customization choices.

Unlike plots, where individuals have complete freedom in designing and constructing their homes according to their preferences, flats often restrict these options.The lack of control can lead to compromises in terms of layout, design, and materials used.

Additionally, flats generally come with a predetermined floor plan and limited scope for personalization. This can be a disadvantage for those who have specific requirements or preferences in terms of room sizes, layouts, or fittings.

Moreover, the involvement of multiple stakeholders in the construction process can further limit the ability to make changes or modifications.

Pro Tip: Before investing in a flat, it is advisable to carefully consider your individual needs and preferences regarding construction and customization. If having control over these aspects is important to you, exploring plot options might be more suitable for your investment goals.

Design your dream home without limitations on a plot, because who needs generic cookie-cutter flats anyway?

Plots – Complete freedom in designing and construction process

Unlike flats, where construction is already predetermined, plots allow for customization at every step of the process. This flexibility allows individuals to have full control over their investment, resulting in a truly personalized property.

In addition to design freedom, plots provide investors with the opportunity to choose the construction materials and techniques that suit their preferences and budget. From selecting high-quality materials to implementing sustainable practices, individuals can ensure that their property meets their specific requirements.

This level of customization is not possible with flats, where construction choices are often limited by predefined plans.

Furthermore, plots also offer greater scope for amenities compared to flats. With ample space available, investors have the freedom to incorporate various features such as gardens, swimming pools, or parking areas according to their preferences and needs.

These additional amenities not only enhance the overall value of the property but also provide numerous benefits for future occupants.

It is important to note that while flats may offer convenience in terms of ready-made construction and minimal decision-making process, they often lack the personal touch and uniqueness that plots afford. By choosing a plot for investment purposes, individuals can create a one-of-a-kind property that reflects their personality and style.

One such example is Mr. Smith’s decision to invest in a plot rather than a flat. He had always dreamed of owning a home that was truly unique and tailored to his tastes. By purchasing a plot of land, he was able to design his dream house from scratch, incorporating all the features he had always wanted.

From customized architectural details to bespoke interior finishes, Mr. Smith’s property became a reflection of his personal style and taste. This personalized approach not only brought him immense satisfaction but also added significant value to his investment over time.

Choosing between flats and plots is like deciding between convenience and creative control – do you want an easy, ready-made home or the freedom to design your dreams from scratch?

Comparison of effort and amenities offered by flats and plots

In the comparison of effort and amenities offered by flats and plots, we analyze the differences in terms of customization options and convenience. Let’s examine a table that showcases these distinctions, providing insight into the benefits and considerations of each option.CriteriaFlatsPlotsConstruction ControlLimited control over construction process and customization optionsComplete freedom to design and construct according to individual preferencesEffort RequiredMinimal effort as construction is undertaken by buildersMore effort involved in supervising construction process and managing contractorsAmenities OfferedGenerally, offer amenities such as security systems, gyms, pools, etc.Amenities depend on individual choices and can be customized accordingly

While the table highlights key aspects of both flats and plots in terms of effort and amenities, it’s important to note that flats offer convenience in terms of predetermined construction processes, while plots provide the opportunity for personalization.

Consideration should also be given to the efforts required in supervision for plot construction compared to relatively minimal involvement in flat construction.

To make an informed decision between plot or flat investments based on this comparison, individuals should carefully consider their preferences for customization, level of involvement in the construction process, and desired amenities.Ultimately, aligning investment goals with personal requirements will lead to a better investment choice.

Choosing between constructing a flat or a plot? Consider the expense involved and how location influences construction costs.

Expense Involved in Construction: Location vs Position

When it comes to the expense involved in construction, the location and position play crucial roles in determining the cost. Let’s dive into the factors influencing the cost of constructing a flat and the factors determining the construction cost of a plot.

By analyzing the cost considerations for both options, we can gain valuable insights into the economic aspects of investing in either a plot or a flat. So, let’s explore how location and position impact the financial aspects of these investment choices!

Factors influencing the cost of constructing a flat

The cost of constructing a flat can be influenced by various factors. These factors directly impact the overall expenses involved in the construction process. By understanding these influences, potential homebuyers and investors can make informed decisions regarding their investment in flats.

To better understand these factors, let’s take a look at the table below:FactorsDescriptionLocationThe geographical area where the flat is builtSizeThe total area of the flatMaterialThe quality and type of construction materials usedLaborThe cost of hiring skilled labor for construction tasksAmenitiesAdditional features and facilities provided in the flat

Location plays a vital role in determining the cost of constructing a flat. Areas with high land prices or higher demands tend to drive up construction costs. The size of the flat also impacts expenses, as larger flats require more materials and labor.

The quality and type of construction materials used significantly influence costs. High-quality materials often come at a higher price point but contribute to the durability and value of the flat. Skilled labor is another essential factor that affects construction costs.

Finally, amenities provided within the flat can increase its overall cost. Luxurious features such as swimming pools, gyms, or parking spaces may entail additional expenses during construction.

In considering these influencing factors, it is crucial to evaluate one’s budget, preferences, and long-term goals before making an investment decision related to flats.

True Story: Maria was looking to buy a new apartment in a prime location in her city. She found an affordable option but soon discovered that its construction costs were lower due to compromising on material quality and lack of amenities compared to other options nearby.

Realizing that cutting corners on these influencing factors might lead to future problems and depreciated property value, Maria decided to invest in a slightly more expensive flat that ensured high-quality materials and better amenities for long-term satisfaction and value.

Building a plot can be costly, but the freedom to design and construct it exactly as you want is worth every penny.

Factors determining the construction cost of a plot

To understand the determinants better, let us take a look at a comparison table:FactorsDescriptionLocationThe geographical area and its proximity to basic facilities and amenities such as schools, hospitals, markets, and transportation options play a significant role in determining the cost of constructing on a plot.Size of the PlotThe size of the plot directly impacts the overall construction cost. Larger plots may require more materials and investment for construction compared to smaller ones.Construction MaterialsThe quality of construction materials chosen for building on the plot affects its cost. Higher quality materials tend to be more expensive but can contribute to better durability and longevity of the constructed property.Labor CostsThe availability and skill level of laborers in a particular area can impact construction costs. Areas with higher demand for skilled labor may have higher labor costs compared to areas where labor is abundant.Additional Amenities or FeaturesAny extra amenities or features desired for the construction, such as swimming pools, gardens, parking spaces, or elevators, will add to the overall cost of constructing on a plot.

It is important to note that these are just some key factors among many others that can influence the construction cost for plots.

A thorough analysis of these factors will help potential investors or homebuyers make informed decisions when considering buying a plot and understanding its associated costs.

In order to make sound investment choices, it is crucial to carefully assess each factor mentioned above and evaluate them in relation to your budgetary constraints, goals, and preferences.

Don’t miss out on this opportunity! Evaluate all these factors diligently before making any decisions pertaining to investing in a plot as they can significantly impact your overall investment journey.

Comparing the cost considerations for flats and plots, let’s see which option won’t break the bank.

Analysis of cost considerations for both options

When analyzing the cost considerations for both plot and flat options, it is essential to carefully evaluate various factors. These factors include construction type, expense involved in construction, return on investment/appreciation of property, income from property, risk involved, financing options, and tax benefits.

By thoroughly assessing these aspects, investors can make a well-informed decision regarding their investment choices. In considering the cost considerations for both options, a table can highlight the key points. The table would include columns such as:Construction TypeFreedom vs ConvenienceExpense Involved in ConstructionLocation vs PositionReturn on Investment/Appreciation of PropertyAge vs ScarcityIncome from PropertyRent vs DevelopmentRisk InvolvedConstruction Quality vs LitigationFinancing OptionsEase vs ComplicationTax BenefitsMonthly Repayment vs Construction Completion

This format will provide a clear comparison between the two options and allow investors to weigh their financial implications accurately. Furthermore, it is important to note that beyond cost considerations, each option offers unique details that should be taken into account.

For instance, while plots offer complete freedom in designing and construction processes, flats may lack control over customization.

Additionally, the rising value of plots due to increasing demand and scarcity can impact their return on investment compared to flats. These additional aspects contribute to the overall assessment of the best investment option based on individual requirements and preferences.

To illustrate this point further, consider the story of Mr. Smith who invested in a plot for construction purposes. Over time, he managed to build multiple apartment units on his plot which not only generated long-term income but also appreciated significantly in value.

This success story highlights how investing wisely in plots can lead to substantial returns and financial growth. Overall, understanding and analyzing the cost considerations for both plot and flat options is crucial when making an informed investment decision.

By evaluating factors such as construction type, expense involved in construction, return on investment/appreciation of property, income from property, risk involved, financing options, and tax benefits, investors can align their goals and preferences to choose the right investment option.

Flats may age, but plots become a scarce commodity, making them a prime investment for the future.

Return of Investment/Appreciation of Property: Age vs Scarcity

When considering investments in real estate, one crucial factor to analyze is the return on investment and appreciation of the property. In this section, we will explore the correlation between property age and scarcity and how they influence the value of different types of properties.